For many small to medium-sized nonprofits registered in Pennsylvania, the requirement that a CPA provide assurance on their financial statements has been a substantial expense, money better used for their charitable missions. House Bill 1420 has amended the Solicitation of Funds for Charitable Purposes Act to increase the thresholds used to determine when, and to what extent, CPA assurance is required for the annual financial statements of charitable organizations registered with the State.

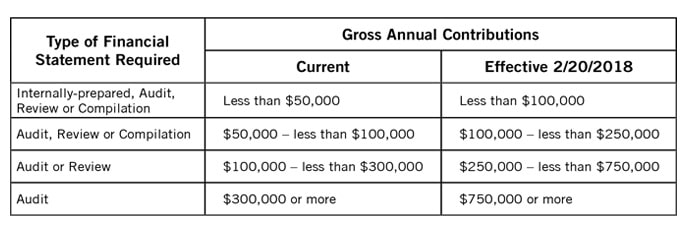

The Act continues the requirement for either internally-prepared, compiled, reviewed or audited financial statements. However the contribution ranges for which these various levels of assurance are necessary have been increased, as illustrated in the table below:

The definition of “gross annual contributions” remains unchanged as “total national contributions from all sources based on the organization’s immediate preceding fiscal year end.”

The new thresholds apply to all charitable registration renewals due February 15, 2018 or later (for March 31, 2017, fiscal year ends or later) and to all new charitable organization registrations filed on or after February 20, 2018. The Act should reduce compliance costs for smaller organizations and more closely aligns Pennsylvania’s requirements with those of the current Federal Uniform Guidance.

If you have questions or would like to discuss the impact of this change on your organization, contact Sean Kocan or your trusted HBK team member.

Speak to one of our professionals about your organizational needs

"*" indicates required fields