When the Tax Cuts and Jobs Act (TCJA) was issued, we noted that several areas of the new law that needed clarification. One of those addressed the deductibility of expenses for meals and entertainment. We have provided up-to-date information as the IRS and Treasury has sought to clarify the changes made under TCJA. Recently the IRS released additional information relating to entertainment, meals and certain holiday and other celebratory party expenses and their deductibility.

Background

Travel and meal expenses are generally deductible if they are ordinary, necessary, and reasonable expenses that are related to or associated with the active conduct of an entity’s trade or business and are properly substantiated. No deduction is permitted for any personal, living, or family expenses. Under the new Tax Cuts and Jobs Act (TCJA), no deduction is permitted for any entertainment expense after December 31, 2017, and pursuant to Notice 2018-76 and the final regulations issued by Treasury, when qualifying meal expenses occur in conjunction with entertainment expenses special provisions apply to preserve the deductibility of the qualifying meal.

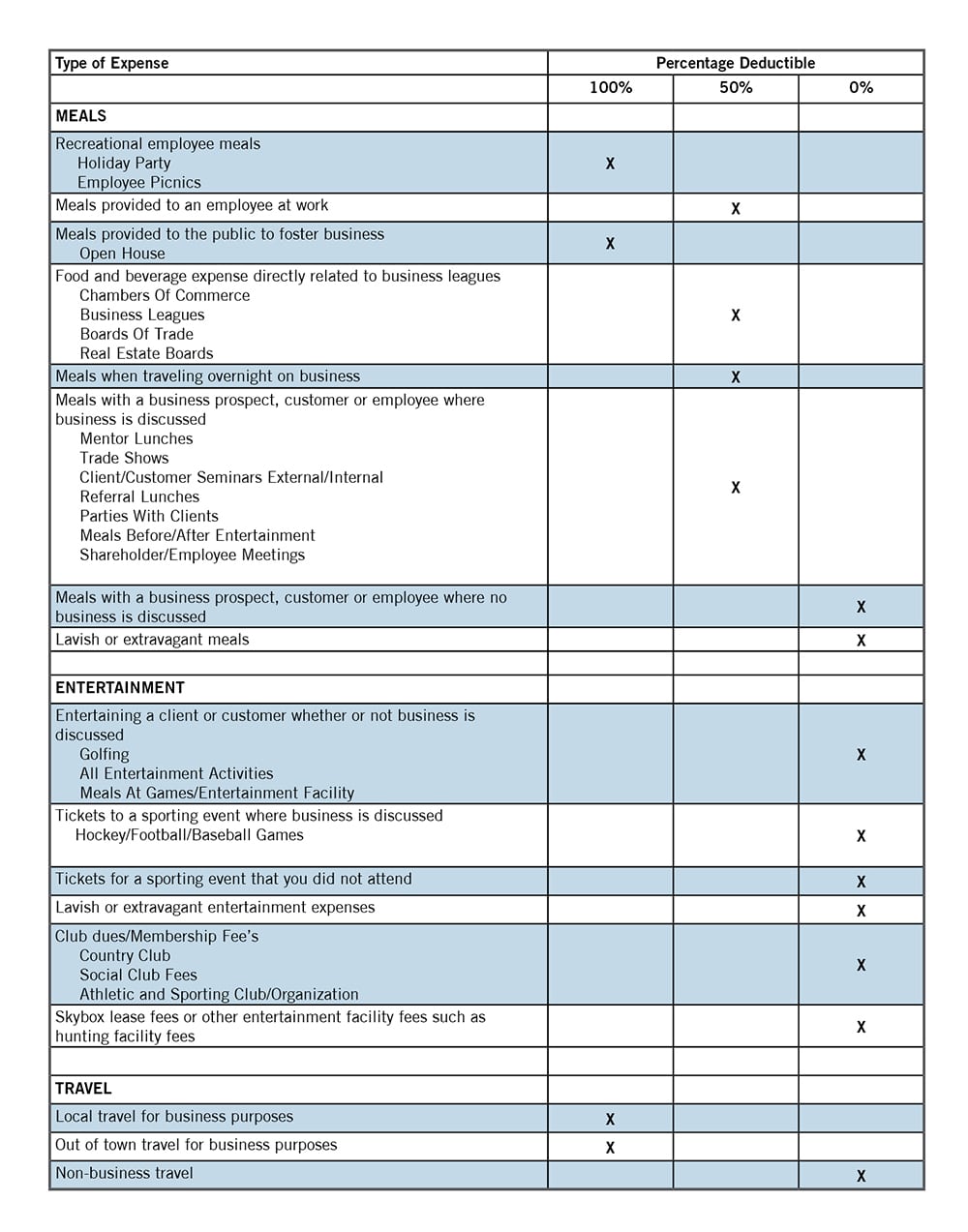

Below is a breakdown of the most commonly occurring categories that may impact your business based on the updated information released by Treasury.

Employee Recreation Meals

The IRS has released guidance on various employee recreation meals this week and has clarified that the changes under the TCJA did not eliminate the carve-out for deductibility of qualifying “recreational” meals. Employee recreation meals that are for the benefit of employees, and/or their family members are 100% deductible, so long as these events do not include clients, contractors, or prospects. Employee recreation meals are generally meals at employee recognition events, holiday events, employee picnics and outing events, and events associated with team building exercises. Meals at Holiday parties, picnics for employees, and other fun and recreational type activities that benefit all employees are 100% deductible. Meals that are in conjunction with entertainment beyond the scope of employee recreation meals are discussed in the entertainment section below. Meals and snacks put in break rooms, pantry’s or other areas where employees congregate and socialize are not considered to fall under the “recreational meal” rules and thus are not 100% deductible.

Meals for the Convenience of the Employer

Meals that are provided by an employer to an employee on the employer’s premises for the employer’s convenience are a deductible as a de minimus fringe benefit. These meals are now limited to 50% deductibility under the TCJA. Prior to the TCJA, these meals were 100% deductible to the employer. Meals that qualify as de minimus fringe benefits may also be excluded from an employee’s gross income. Examples include providing meals to employees during an emergency, or when an employee is on call and would otherwise be unable to secure a proper meal. Similarly, meals that are provided at an employer-operated eating facility, such as a company cafeteria or café, are also subject to the 50% deductibility limitation.

Business Meals and Meeting Expenses

For meals with a business prospect or client, the employer or an employee must be present for the duration of the meal to qualify as a deductible expense. Additionally, these meals must be reasonable and related to or associated with the active conduct of business. Thus, expenses that are related to business meetings of employees, owners, agents, and directors will remain 50% deductible.

Entertainment Expenses

Under TCJA there is no deduction permitted for any entertainment expense. This applies to any expense for any activity that is considered entertainment, amusement or recreation. The term “entertainment” includes night clubs, cocktail lounges, theaters, country clubs, sporting events, golf and athletic clubs, trips for hunting, fishing, or similar, vacation trips, or any other activity relating to amusement or recreation.

The location of business meals will now need to be considered to determine whether they are a nondeductible entertainment expense. Expenses for entertaining clients or prospects are no longer deductible. Sporting and other entertainment tickets are no longer deductible, even if a business purpose exists. The IRS has issued Notice 2018-76 and the final regulations provide that taxpayers will be allowed to deduct half the cost of meals, but only if they meet the following requirements:

- The expense is an ordinary and necessary expense under §162(a) that is paid or incurred during the taxable year in carrying on any trade or business;

- The expense is not lavish or extravagant for the circumstances;

- The taxpayer, or an employee of the taxpayer, is present when the food or beverages are purchased;

- The food and beverages are provided to a current or potential business customer, client, consultant, or similar business contact; and

- In the case of food and beverages provided during or at an entertainment activity, the food and beverages are purchased separately from the entertainment, or the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bill, invoice, or receipt. The entertainment disallowance rule may not be circumvented by inflating the amount charged for food and beverages.

Speak to one of our professionals about your organizational needs

"*" indicates required fields