UPDATE: PLEASE NOTE THAT THE IRS ISSUED CHANGES TO THIS RULING. PLEASE SEE THE NEW ARTICLE DATED OCTOBER 2, 2020 FOR DETAILS ON THE UPDATES.

The 2017 Tax Cuts and Jobs Act (TCJA) dramatically altered the Internal Revenue Code as it relates to the deductibility of entertainment expenses and the meals associated with that entertainment. Entertaining is an activity that many businesses conduct to engage new clients and customers. These changes will have an immediate effect in 2018 on how businesses deduct these expenses and whether they want to continue to incur the costs associated with entertainment.

Meals

Meal expenses are generally deductible if they are ordinary, necessary, and reasonable expenses that are directly related to or associated with the active conduct of an entity’s trade or business and are properly substantiated. For meals with a business prospect or client, the employer or an employee must be present for the duration of the meal in order to qualify as a deductible expense. No deduction is permitted for any personal, living, or family expense. Under the new Tax Cuts and Jobs Act (TCJA), the 50 percent deduction for these meals is still mostly intact.

One major change is in regards to meals that are provided by an employer to an employee on the employer’s premises for the employer’s convenience (previously a deductible de minimus fringe benefit). These meals are now limited to 50 percent deductibility under the TCJA. Prior to the TCJA, these meals were 100 percent deductible to the employer. Examples include providing meals to employees during an emergency, or when an employee is on call and would otherwise be unable to secure a proper meal. Similarly, meals that are provided at an employer-operated eating facility, such as a company cafeteria or café, are also subject to the 50 percent deductibility limitation.

Entertainment

All expenses incurred for entertainment, amusement or recreational expenses, including meals related thereto are not deductible after 2017. This is a major change as these expenses were previously 50 percent deductible to the extent that had business purpose. Entertainment includes any activity of a type that is generally considered to constitute entertainment, amusement, or recreation, such as entertaining at night clubs, cocktail lounges, theaters, country clubs, golf and athletic clubs and sporting events, and on hunting, fishing, vacation, and similar trips.

Nondeductible entertainment expenses also include membership fees and dues for any club organized for business, pleasure, recreation, or other social purposes, and any facility fees connected with any of the listed items.

The good news is that the following pretty much survived the entertainment restrictions. Activities with continued deductibility include:

- Entertainment, amusement, and recreation expenses you treat as compensation to employees and that are included as wages for income tax withholding purposes;

- Expenses for recreational, social, or similar activities (including facilities therefor) primarily for the benefit of employees (other than employees who are highly compensated employees). This would include company picnics or holiday parties;

- Expenses that are directly related to business meetings of employees, stockholders, agents, or directors (here, the law limits expenses for food and beverages to 50 percent);

- Expenses directly related and necessary to attendance at a business meeting or convention such as those held by business leagues, chambers of commerce, real estate boards, and boards of trade (here, the law also limits expenses for food and beverages to 50 percent);

- Expenses for goods, services, and facilities you or your business makes available to the general public;

- Expenses for entertainment goods, services, and facilities that you sell to customers; and

- Expenses paid on behalf of non-employees that are includible in the gross income of a recipient of the entertainment, amusement, or recreation as compensation for services rendered or as a prize or award.

The Take Away

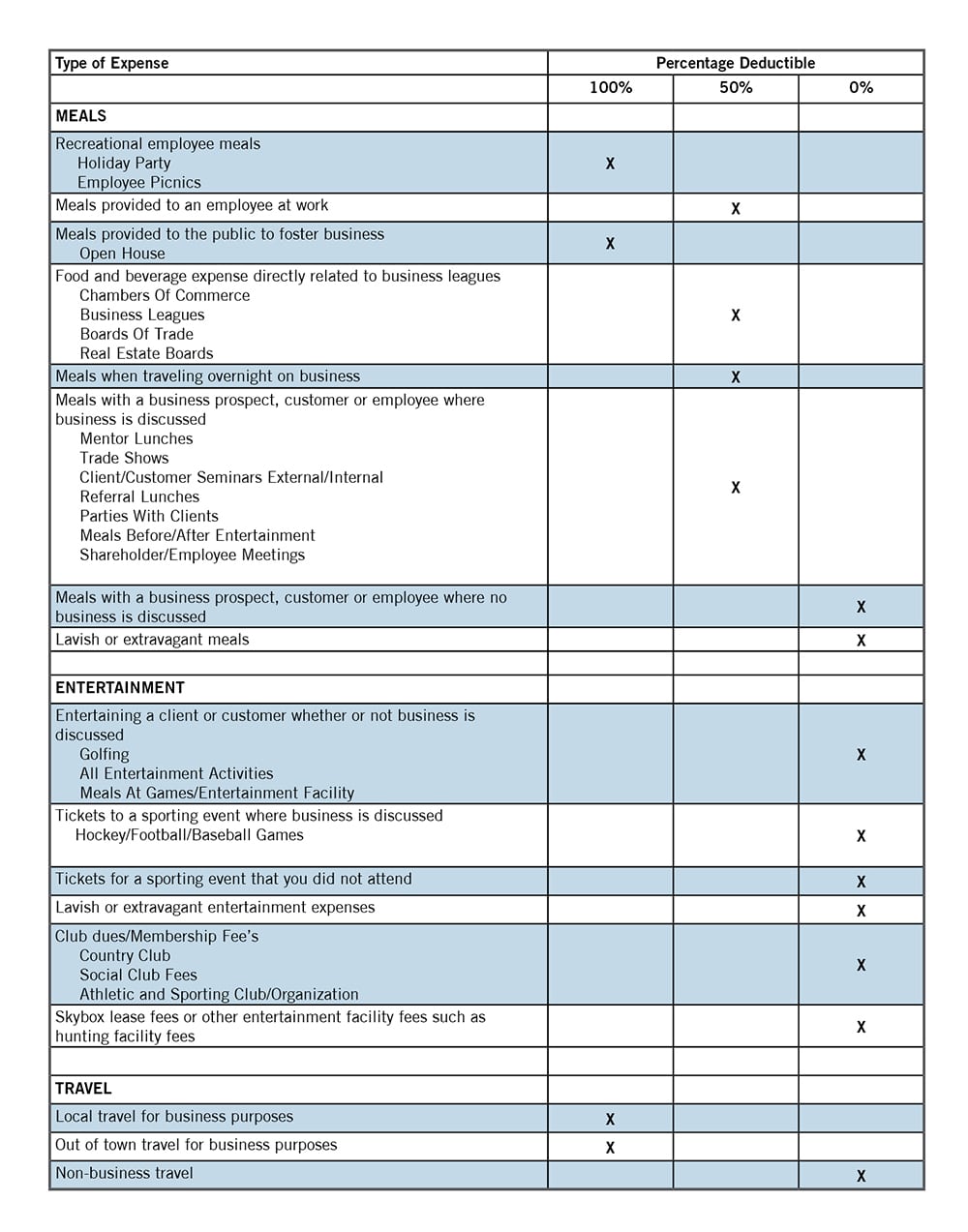

The TCJA changes how entertainment expenses will have to be tracked within a business to determine proper deduction treatment. As mentioned in the above sections, this legislation will most likely change how businesses entertain customers, prospects and employees. Attached is a chart, which summarizes the deduction treatment in 2018 and beyond for many of the most common expenses business may encounter.

Speak to one of our professionals about your organizational needs

"*" indicates required fields