Speak to one of our professionals about your organizational needs

"*" indicates required fields

"*" indicates required fields

During a crisis like COVID-19, fraudsters move quickly to develop new schemes to take advantage of consumers through misinformation and scare tactics. Their mode of communication runs the gamut: phone, email, postal mail, text, social media. Within a month of the COVID-19 outbreak, China experienced a surge in phishing scams directing targeted victims to malicious websites; over 4,000 new domain names incorporating some form of COVID-19 were requested.

Identity Fraud

As always, with or without a crisis in play, everyone should protect their money and identity by not sharing personal information, such as:

While the subject of economic stimulus checks has been a topic of much discussion in the news recently, the U.S. Government is not sending—nor will they send—unsolicited emails seeking your private information. Other potential phishing email topics include:

Be aware of unsolicited fake emails from the Centers for Disease Control and Prevention (“CDC”) and the World Health Organization (“WHO”). If the email looks questionable, hover over the link in the email to identify the source, that is, the website address from which it was issued. Focus on any slight inconsistencies in the domain address, such as misspellings or a suspicious link—for example, an address ending in “.com” for a supposed government website that, were it legitimate, would end in “.gov.” Do not click on untrustworthy attachments or links. Clicking on an inappropriate link subjects your computer system to malware—and malware’s goal is to steal personal information or to lock your computer and demand a ransom to unlock it.

Also, be wary of websites and apps claiming to track COVID-19 cases worldwide. Fraudsters are using malicious websites to infect and lockdown devices until payments are received. If you are looking for accurate and up-to-date information on COVID-19, the best sources of information are:

Fraudulent Products

The U.S. Food and Drug Administration (“FDA”) has issued letters to seven companies warning them to stop selling fraudulent COVID-19 products. The fraudsters are trying to tempt consumers to buy or use questionable products that claim to diagnose, treat, cure or prevent the virus. The products have not been evaluated by the FDA for safety and effectiveness and could be dangerous. A few of the fraudulent, misleading types of products are:

As well, test kits sold online for COVID-19 are not authorized by the FDA. The FDA has not authorized a home test for COVID-19. Currently, the only way to get tested is through your healthcare provider. Temporary COVID-19 testing facilities have been set up in many areas; they require a prescription from a healthcare provider.

The FDA offers the following tips to identify false or misleading claims:

The best way to protect your financial assets is to stay on top of your bank accounts, credit card statements, and retirement accounts by monitoring your transactions. Each of the three major credit reporting companies—Experian, TransUnion and Equifax—offer a free annual credit rating report; taking them up on that offer is a financially sound practice.

Stay safe and be wary of the new wave in fraudulent schemes.

"*" indicates required fields

Like most things, the buying and selling of businesses has taken a pause as the nation works its way through the COVID-19 crisis. M&A activity has slowed largely as a result of the considerable difficulty the experts are experiencing in arriving at valuation calculations that both buyers and sellers can agree on. In most cases, owners have put their intentions to sell on the back burner, and are focused on getting their companies through the crisis and coming out on the other end intact. So how are the professionals who advise business owners on M&A activities looking at the issue and what are they recommending to their clients, especially those clients who before the onset of the pandemic were looking to sell as their exit strategy? We asked Keith Veres, a Principal at HBK CPAs & Consultants, who, as Director of the firm’s Corporate Finance division and a Certified Exit Planning Advisor helps clients looking to raise capital, acquire businesses or sell their business, and Robert Zahner, a Senior Manager with the HBK Valuation Group who executes valuations and related technical services for businesses looking to acquire or sell.

Q. How has COVID-19 slowed the pace of M&A?

Veres: The questions at the center of any M&A transaction revolve around the value attributed to the companies involved in the proposed transaction. How do you value a business in this climate, especially when companies are not yet certain just how much revenue they may be losing—or gaining, as is the case with some companies? A buyer will always look at historical information but is more interested in forward-looking projections, because anyone buying a business wants to know what’s it going to do when they own it. They’d want to determine how all facets of that business are going to be affected by the pandemic, including what has happened to suppliers and customers and the collectability of accounts receivable. To determine a price, you need to know what it’s worth now, what are the value drivers and detractors? Is the business transferable and attractive? Getting to the bottom of these critical questions required considerable effort under normal circumstances. What we are all dealing with now has added new levels of complexity to the business valuation process.

Zahner: There’s no question that the current crisis has put sellers at a disadvantage, even if some industries have been well positioned to react to COVID-19, including certain retailers, household staples manufacturers, and technology companies. But for the most part, it’s advantage buyers. Many buyers, though, have also been forced to put their M&A activity on hold. Cash is short, and they likely have their own problems to tend to. However, companies with strong balance sheets and private equity groups with “dry powder” could be out in search of deals at a discount. Sellers are wary of this; if they aren’t, they should be. Many are taking a wait-and-see approach. Not many want to buy an enterprise that isn’t sure how to forecast its cash flows through the end of this year, let alone two to three years into the future. And as Keith said, the uncertainty can lead to widely disparate valuations between buyers and sellers, which makes deal-making difficult.

Veres: Many buyers of small businesses use SBA lenders, and most M&A activity through those channels has been put on pause for at least the next 30 to 60 days. Each business is unique—not only their business type and historical financial performance, but their ownership group, their employees, their community, their market. It’s why we say, “If you’ve seen one M&A transaction, you’ve seen one M&A transaction.” We’ve been talking with our strategic partners—attorneys, investment bankers and business brokers—and it’s unclear how the crisis will ultimately affect each business. Relationships, as they exist between suppliers and customers, will change. So many unknowns are having an impact on the valuation process right now.

It is a very difficult time for business owners who have been contemplating their exit strategy because buyers understand that revenue is down, unemployment applications are what they are. What’s the fallout of all that? How do you value a company that for three decades has been performing in a fairly consistent and predictable manner? How will that valuation look in two to three years? It’s why you see the equities markets fluctuating like they are. They’re having difficulty following the value implication for companies all the way through to the end. Most buyers are pausing unless they think they can get a bargain. For business owners preparing to exit, it’s going to be very difficult, except under certain circumstances, to command the value they could have commanded three months ago.

Q. What should sellers do now during the crisis period?

Zahner: Unfortunately for many business owners contemplating an exit, current market dynamics have likely eroded value and put sellers at a disadvantage compared to just months ago. Therefore, a practical strategy for sellers may be to weather this storm the best they can, then look at it again on the other side. If your company has certain strengths that allow it to do so more effectively, like a nimble supply chain or easy scalability in either direction, now is the time to build on those strengths and tell the story once the crisis is through.

Veres: One thing we’re telling business owners is that it is important to go through the valuation process, if only to determine what it is that drives the value of their business and look at their business from a buyer’s perspective. They might not have done that level of analysis at least in the recent past, that is, put on a buyer’s glasses and see what things make the business valuable and what things might detract from the perceived value. A buyer will do their due diligence on your business and look for reasons to re-price what their initial letter of intent indicated as their offering price. That’s now standard operating procedure. So when we’re going through the process of looking at their business from the buyer’s perspective and uncovering real value drivers, it allows us to determine where business owners should be spending their time. Their time should be spent making their business as attractive and easily transferable as possible. Most things that will help a business get prepared for a sale are things that will also help them weather storms like the one we are in right now.

When a buyer is looking at a business, they’re looking at a risk-return proposition. Typically the lower the risk, the higher the value they will place on your business. If you can come out on the other side of this pandemic and prove that you survived a historic attack on your business, that might prove a significant differentiator for you when it comes time to market your business to potential buyers.

There’s a wave of baby boomers contemplating their exit strategies. Some of them might use the crisis to take the steps to improve their business that they were dragging their feet on before.

Zahner: The two things that have arguably impacted value the most are supply chain disruption and the demand shock with everyone staying home. A lot of businesses will be looking at their supply chains with the idea of tweaking them to make their companies more attractive. Do they have the proper contingencies in place? Should they be looking at different geographic regions or keeping things closer to home? What is the best strategy to maximize responsiveness? Also, it’s important to think about how business activity will be forever changed on the other side of the COVID-19 pandemic. Strong, flexible IT environments will be more important than ever, as will changing customer preferences. I believe that the current crisis has accelerated shifts that were already in motion; telemedicine, grocery delivery/pickup, how we get our hands on essential household products.

Veres: Also, a lot of businesses will reconsider how much they spend on brick and mortar given that remote work is proving to be an option. Business owners will learn that they didn’t miss too many beats having 80 or 90 percent of their people working from home. So maybe 30 or 40 percent of their workforce could continue working at home, thus reducing the square footage required to house their employees.

Q. What do you see on the other side of this crisis for M&A activity?

Veres: Sellers are going to have to be creative. In deal making that’s going to be a necessity because there are so many unknowns moving forward. There will likely be more deals with an earn-out attached to them. Getting a buyer and seller to come together over a value is going to be more difficult; there’s plenty of ammunition on both sides to dispute attaching a definitive value to a business that is in transition. We will see concessions being made that allow for a valuation to play itself out in terms of future revenues and profits. Sellers might also be asked to take on larger notes receivable from buyers instead of having the buyer come up with 90 percent at closing. Sellers might need to take on some additional risk. There’s going to be more consternation on both sides, but when you have a willing buyer and seller, you should be able to work it out. Deals are still going to happen.

Zahner: I think there will be fewer buyers and sellers for a period of time. How long that goes is anyone’s guess. No one is sure when the recovery will start, or if values will rebound to pre-crisis levels, but once the virus has been controlled and self-isolation mandates are lifted, business and consumer confidence will rise, and possibly quickly. But for now, everything’s against the seller. Any influx of capital will be more for operations and working capital than deal making. Earn-outs and “holding the paper” on deals might get the buyer to pay more in the long run, but the deck is stacked against the seller at this time. So if you don’t have to sell, you’ll likely want to wait.

Q. Do you have deals in the making for any of your clients now?

Veres: Yes. There are some deals in the due diligence process where legal documents have been signed. Contracts may include a force majeure clause that allows the buyer to step away from the deal under extraordinary circumstances. A deal without that clause could still be enforceable. There are other contractual issues that can cause the sale to be delayed, like deals that were scheduled to be SBA financed that are now on hold. Some businesses are more protected from societal and economic turmoil and may see their deals still go through. Again, every deal is unique, but most are taking a deep breath and pausing.

There was a lot of money out here looking for a market correction, but who would have thought of a pandemic and a Saudi-Russian oil war happening at the same time? We had expected a pullback from such a long period of increasing business values, and there was a lot of money on the sidelines waiting for that. I believe activity will ramp up when there’s a recovery—there is a lot of dry powder looking for an opportunity.

Zahner: From a valuation perspective, there are a lot of things we’re dealing with now that don’t have much to do with transactions. What we’re doing as a valuation group is addressing cash flow issues and market conditions and working with our clients to try to quantify the impact as accurately as possible. The valuation date plays an important role in this. Was the crisis known or knowable as of a certain date in time? Once it was knowable, what were the cash flow impacts? How long will they persist, and how quickly will things return to normal? These are all very difficult questions, some of which are unanswerable. When we don’t know those things we have to incorporate the impact of the crisis in other ways. We can adjust our selected rates of return and apply lower value multiples based on revised market capitalizations. We just have to be careful not to double-count certain factors. For example, it’s probably inappropriate to apply depressed earnings multiples to recast projections that have already incorporated negative performance. But in general, the transaction process won’t re-start until we get back to some normalcy.

Q. What are your recommendations to owners planning their exit strategies?

Veres: We’re recommending to anyone contemplating what is likely the most significant transaction of their lives, the sale of their business, to assemble their team of advisors who will help them through the process. Business owners had become a little complacent about having accurate valuations for their businesses. They were getting comfortable applying vague “rule of thumb” calculations to estimate value. Moving forward, the valuation process is going to be much more complicated than that. You need a qualified professional advisory team—investment banker or business broker, attorney, CPA, financial advisor and a valuation expert. We’re all here to help you get the best price and terms whenever it is that you want to execute a transaction. It has never been more necessary to have people like us to help you down that path.

Whether it’s an internal or external exit strategy, you want to understand all your options. A vast majority of business owners are not aware of all of their options. They think it’s either sell or close the doors. It will be important to talk about other options. Are there opportunities for joint ventures? Might you consider making some of your own acquisitions? There are thoughtful conversations to be had with buyers and sellers to consider their options.

Zahner: If you don’t look at it from a selling perspective, you might consider passing the business on to the next generation. Strategies like gifting are very attractive now, especially with a taxable estate. With market conditions as they are and uncertainty swirling, fair market value has dropped, and transfers can be made at supportably lower values. I want to be clear that we aren’t suggesting that values are artificially low. Risk profiles are growing. Cash flow is plummeting. These are real concerns for our business owners, and value will be impacted accordingly. Therefore, it could be a good time to get with your estate planning professionals to see if the timing might be right.

Veres: Many of our clients had originally anticipated that their kids would take over the business when Mom and Dad were ready to retire. Many of those same business owners later became aware of the fact that their kids had other plans for themselves. Those other plans may no longer be available and it might be time to reconsider keeping the business in the family. Maybe some of the togetherness during this crisis will percolate that thinking. Mom and Dad’s original intent for the business might happen after all. If this is an option, get the valuation experts to work and have the tax and financial planners help you craft the best plan to keep the business in the family.

Owners are optimistic people. They are entrepreneurs and have shouldered risk and responsibility for many years. Their expectations are that they’re going to come out on the other side better for it and still execute their exit plan at some point. We can help them see that they may now have more time for a thoughtful approach to the process. Most business owners have a passionate relationship with their business. They have probably invested the vast majority of their time and money into their businesses and they will do everything they can to get through this. We can do our part by helping them execute a successful exit strategy when they are ready to do so.

Note: For more on exit strategy options, read Leaving Your Business on Your Terms at HBKSwealth.com.

"*" indicates required fields

"*" indicates required fields

In his public COVID-19 briefing on Tuesday, March 31, President Trump proposed a $2 billion infrastructure bill as the next piece of legislation to boost a post-pandemic U.S. economy. Although many lawmakers agree with the President, exactly what projects should be done and, more importantly, where the money will come from are points of contention.

The President proposed that the country should take advantage of historically low interest rates to borrow inexpensively to finance the infrastructure work. In a tweet he said, “With interest rates for the United States being at ZERO, this is the time to do our decades long-awaited Infrastructure Bill. It should be VERY BIG & BOLD, Two Trillion Dollars, and be focused solely on jobs and rebuilding the once great infrastructure of our Country! Phase 4.”

Rumors have the White House and Congress discussing ideas for a fourth round of stimulus due to the coronavirus outbreak. House Speaker Nancy Pelosi told reporters, “The President said during the campaign—and since—infrastructure was a priority for him. So that’s why we believe that in terms of recovery, that’s probably the most bipartisan path that we can take.”

The bill could be a boon to a construction industry currently under severe duress due to projects lost to the pandemic. According to the website The Hill, lawmakers “suggest the bill could include updates to public drinking water systems and hospital capacity, as well as upgrades to rural broadband in light of increased teleworking and online schooling during the pandemic. The upshot would include additional jobs at a time when unemployment filings are skyrocketing into the millions.”

The dictates indicate the nation is on a path to getting what has been rumored for years, an infrastructure support bill that will have bipartisan support. The Phase 4 bill could allow the U.S. to move forward with the work that everyone seems to agree we need, but no one has been willing to commit to. While we only have a tweet and comments to the media to confirm such a commitment, we seem to be moving in the direction of an infrastructure bill.

According to levelset.com, a website that advocates for construction businesses, the CARES Act, which was signed into law on March 27, contains elements of stimulus for the construction industry. In an April 2 posting, the site noted: “In particular, contractors who work on healthcare and public works projects could see a sharp uptick in jobs as infrastructure and hospital projects get off the ground quickly. In most states and cities so far, construction, in general, is considered an essential business, and projects are being allowed to continue even as governors issue stay-at-home orders.” The site points to $100 billion in emergency grants to hospitals that could be used for new construction projects to increase patient capacity, and another $150 million “to prevent, prepare for, and respond to coronavirus, domestically or internationally, including to modify or alter existing hospital, nursing home, and domiciliary facilities in State homes.”

We will continue to provide infrastructure legislation updates as more information becomes available. Meanwhile, if you have questions or concerns, call HBK CPAs & consultants at (330) 758-8613; or email me at mkapics@hbkcpa.com.

"*" indicates required fields

The effects of the COVID-19 crisis have been abrupt and wide ranging. As of March 23, the S&P 500 had declined nearly 30 percent from its highs just a few weeks before. But while the picture may seem bleak at present, history tells us we will come through this crisis stronger, more educated, and better prepared for similar crises. A look to our past might shed some light as to what the future might hold for investors.

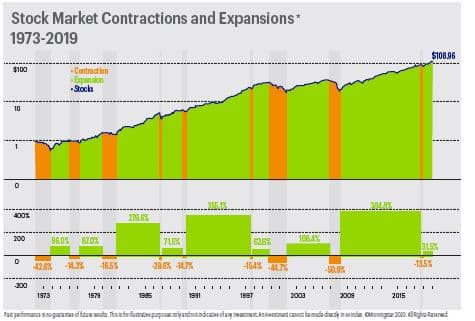

The stock market is cyclical. There are periods of contraction and expansion. There have been eight market downturns in the last 47 years. While some periods of decline have been severe, the overall market has grown over time. No one can predict when the overall market will contract. But looking at historical data, we can gain insight and perspective on what a recovery looks like and what we could expect after this recent volatility.

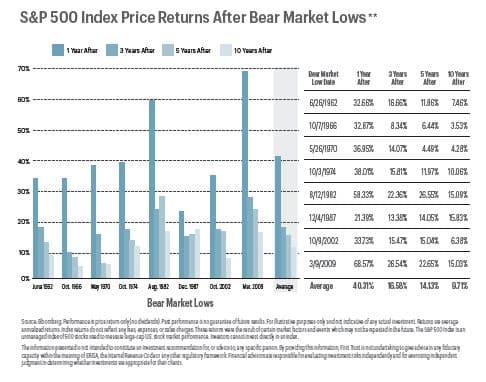

The following chart shows the S&P index has often seen significant double-digit returns in the years following a bear market. In looking at the last eight bear-market lows, the average returns for the following year are 40.31 percent. This figure is stunning, but consider the three, five and 10-year average annual returns after market bottoms: 16.58 percent, 14.13 percent, and 9.71 percent respectively. The statistics demonstrate the importance of staying invested for the long term.

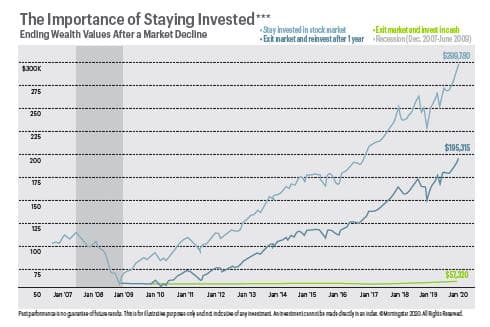

Many longer-term professional investors subscribe to the theory that, “time in” the market is a better strategy than, “timing” the market. Consider the famous bet that Warren Buffet made in 2007 with a hedge fund manager. Buffet claimed that his bet on a broad-based market index would outperform a basket of hedge fund managers over a 10-year period. Buffet bought an S&P 500 index and held his investment for the duration of the wager. At the end of the decade, Buffet outperformed the basket of hedge funds by a wide margin.

The Warren Buffet wager is one example of the importance of staying invested over the long term. Investors who try to time the market often run the risk of losing out on remarkable returns during a recovery period. The following Morningstar chart demonstrates the folly of trying to time the market after the most recent global financial crisis.

It is important to note the disclaimer: past performance is never a guarantee of future results. However, performance over the long term can be a fairly good indicator of what we might expect in the years to come.

In summary:

*Morningstar **First Trust: Source: Bloomberg. Performance is price return only (no dividends). Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. Returns are average annualized returns. Index returns do not reflect any fees, expenses, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index.

***MorningstarIMPORTANT DISCLOSURES The information included in this document is for general, informational purposes only. It does not contain any investment advice and does not address any individual facts and circumstances. As such, it cannot be relied on as providing any investment advice. If you would like investment advice regarding your specific facts and circumstances, please contact a qualified financial advisor.

Any investment involves some degree of risk, and different types of investments involve varying degrees of risk, including loss of principal. It should not be assumed that future performance of any specific investment, strategy or allocation (including those recommended by HBKS® Wealth Advisors) will be profitable or equal the corresponding indicated or intended results or performance level(s). Past performance of any security, indices, strategy or allocation may not be indicative of future results.

The historical and current information as to rules, laws, guidelines or benefits contained in this document is a summary of information obtained from or prepared by other sources. It has not been independently verified, but was obtained from sources believed to be reliable. HBKS® Wealth Advisors does not guarantee the accuracy of this information and does not assume liability for any errors in information obtained from or prepared by these other sources.

HBKS® Wealth Advisors is not a legal or accounting firm, and does not render legal, accounting or tax advice. You should contact an attorney or CPA if you wish to receive legal, accounting or tax advice.

"*" indicates required fields

The COVID-19 pandemic has triggered extreme market volatility and has shaken global economies. This has left investors understandably concerned and uncertain about the future. Our advisors at HBKS are committed to helping our clients get through this difficult time by providing timely information and addressing questions and concerns.

A special webinar hosted by Brian Sommers, Chief Investment Officer at HBKS. During this one-hour discussion, Brian will address the following topics:

1. Short-term and long-term economic impacts of COVID-19

2. Global monetary and fiscal stimulus measures

3. The US Market recovery and what we’ve seen historically

4. Our HBKS investment philosophy and response

"*" indicates required fields

Amy Dalen, JD and Ben DiGirolamo, CPA, JD as they cover the individual and business tax provisions within the recently passed CARES Act.

Topics discussed include:

Individual Stimulus Payments

Retirement Plan Provisions

Employee Retention Tax Credit

Payroll Tax Deferral

Expanded NOL Provisions

"*" indicates required fields

The COVID-19 crisis is forcing many of us to adopt new technologies to maintain our daily personal and professional lives. While video meeting technology, specifically Zoom, is not new to the marketplace, it’s being more broadly employed. But in an effort to accommodate your needs, are you sacrificing security and privacy? In short, yes. But if this is the technology you’ve come to know and love, there are steps you can take to manage your use more effectively.

1. Patch your software: The Zoom software was found to contain a vulnerability that allows remote attackers to steal Windows login credentials and, possibly, execute commands on users’ systems. For individuals, this can mean a compromised identity, financial data, or other personal effects. In a business environment, this can open the door for attackers to compromise other users or systems in a myriad of ways, like by unauthorized disclosure of customer data and through ransomware attacks. Zoom has released an updated version of its software to address this security issue; we recommend you adopt the new version.

2. Add a password: Zoom will automatically require passwords when configuring meetings. However, hosts have the option to disable the requirement. If you are hosting, DO NOT disable. If you are a participant, don’t join a meeting without being prompted to input a password.

3. Be careful where you post the link: Even though you’ve enabled a password to the meeting, the password may be embedded in the invite link. Once a person has the link, they can gain access to your meeting. Be sure to share the link only with participants and do NOT post it on public forums.

4. Lock the meeting: You’ve created a meeting with a password, you’ve kept the link private, and all parties are present and accounted for. Now lock the meeting. Simply refer to the Zoom toolbar, click “Manage Participants,” select “More,” then “Lock Meeting.”

5. Avoid posting pictures: It can be tempting to share screenshots from your Zoom meeting. Perhaps you want to share your office’s virtual happy hour in a display of office comradery. Or maybe you’ve put the college gang back together. It’s best to just keep these moments private as sharing pictures could disclose meeting IDs and information that can be used to hack future meetings. Steps 1 through 4 will help mitigate this risk, but why take the chance?

We continue to learn more about vulnerabilities surrounding Zoom. In fact, despite Zoom’s claims, reports confirmed Zoom does not use end-to-end encryption to protect calling data. Zoom instead uses the same technology, Transport Layer Security (TLS), webservers use to secure websites. TLS does provide some level of encryption and will keep people from spying on your Wi-Fi, but it is not end-to-end encryption and your data is still exposed. As well, while Zoom claims that it does not access, mine, or sell user data, the company was caught sharing users’ device information with Facebook.

Despite the red-flags, Zoom remains a popular video meeting choice. It’s free and easy, but mostly, it’s trendy. Still, you might consider other options like Microsoft’s Teams and Skype, Apple’s Facetime with Signal for added privacy, and Google’s Hangouts.

Stay safe and secure.

For more information, contact the Risk Management Advisory at HBK CPAs & Consultants email me at mschiavone@hbkcpa.com.

"*" indicates required fields

The CARES Act, the phase 3 federal legislation addressing the COVID-19 crisis that was signed into law March 27, includes two key provisions for Medicare Part A and Part B providers and suppliers:

About the AAPP expansion

The AAPP expansion, as distinguished from the SBA loan programs addressed by the legislation, allows eligible providers and suppliers to request up to 100 percent of their Medicare payments in advance for a three-month period. Certain types of hospitals are eligible for additional relief. Given what is known today, each state-specific Medicare Administrative Contractor (MAC) to which a provider or supplier must apply will work to review and issue payments within seven calendar days of receiving the request.

Most non-hospital providers and suppliers will not be required to start repayments of accelerated funds until 120 days after the date of issuance. In the interim, all Medicare claims within that 120-day window will be paid in full. At the end of the 120-day period, claims submitted by a provider or supplier will go to offset its advanced balance until the balance is paid in full or 210 days after funding, whichever comes first. The repayment will be applied automatically.

Submission forms can be found on each individual MAC website, and will vary by contractor. The required Information should be easy to access, and the only calculation are the Medicare payment amounts for the three-month period. Electronic submissions are available, and will reduce processing time, but requests can also be submitted by fax, email, or mail.

While a Paycheck Protection Program (PPP) loan might be more attractive to some organizations, given that the anticipated loan forgiveness would typically cover the majority of private practice overhead, the AAPP program may offer:

Given that these funds must be repaid in a relatively short time frame, it is essential that each practice considers such factors as practice size; specialty; the revenue mix among Medicare, private-pay, and third-party reimbursements; current and future 2020 cash flow planning; seasonality; and physician compensation allocations and formulas.

Click for a fact sheet featuring highlights of the program and a MAC sheet by state.

We’re here to help. Call us with your questions or concerns at (239) 482-5522 or email me at mdeluca@hbkcpa.com.

"*" indicates required fields