On March 18, 2020 the President signed into law the Emergency Families First Coronavirus Response Act (“Bill”), H.R. 6201, which provides relief related to the coronavirus. The Bill amends the Family Medical Leave Act of 1993 (FMLA) to provide for two separate paid leave requirements, which will only apply to employers with fewer than 500 employees, and payroll tax credits to help offset the cost. Here is what you need to know:

Brief Overview of the FMLA

Currently, the FMLA provides eligible employees with up to 12 work weeks of unpaid leave per year, and requires group health benefits to be maintained during the leave. An eligible employee is required to have been employed by their employer for a year, worked for 1,250 hours, and worked in a location where there are 50 other employees within a 75-mile radius. Employers subject to the FMLA are those who employ 50 or more employees or at least 20 work weeks in the current or preceding calendar year.

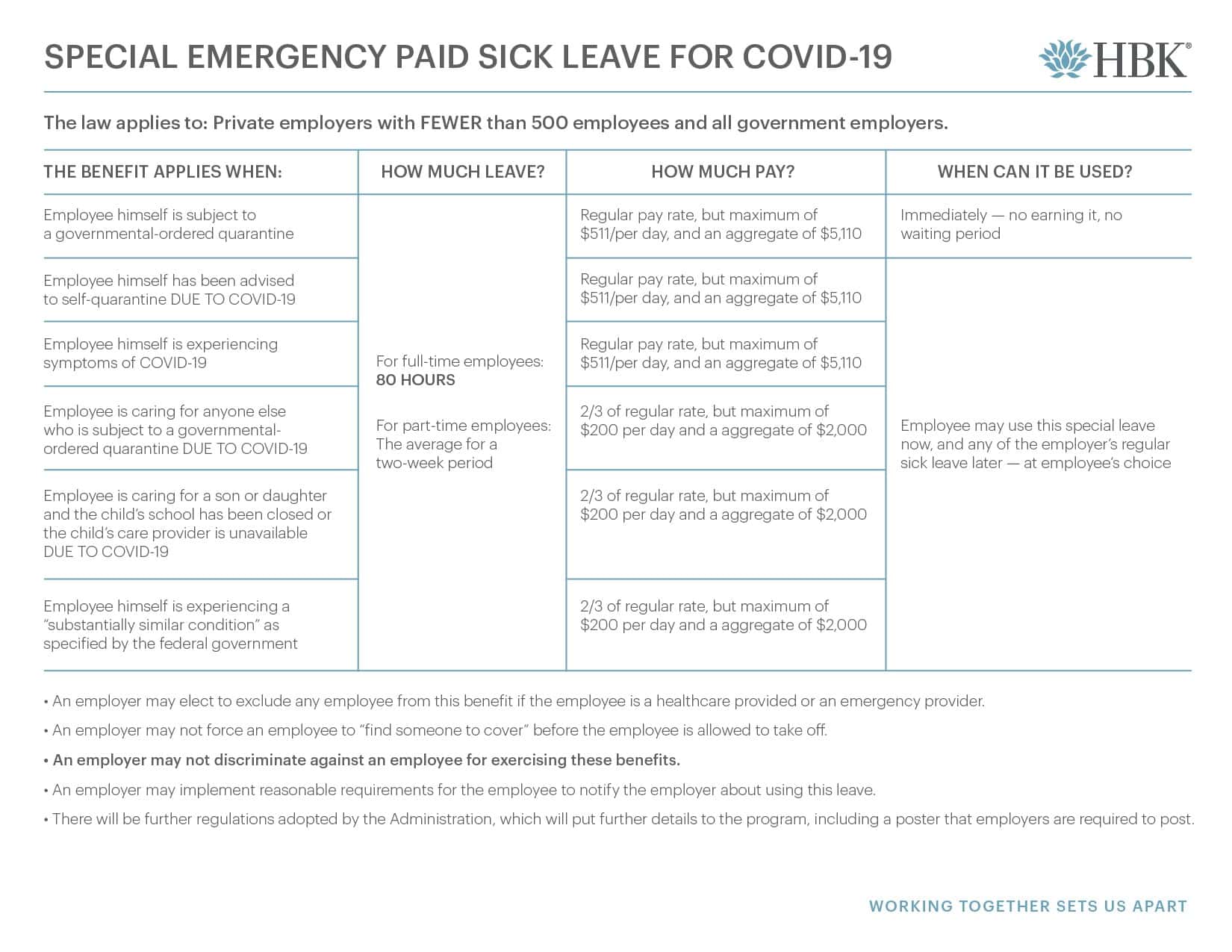

Emergency Paid Sick Leave

The Bill creates a new emergency paid sick leave section within the FMLA that requires employers with fewer than 500 employees to provide a portion of an employee’s 12 work week FMLA leave as paid leave time. The Department of Labor has the ability to issue regulations that would exempt small businesses with fewer than 50 employees from this requirement. This new section only applies through December 31, 2020. To qualify for the paid leave time, an employee must have been employed for 30 calendar days, which is different from the normal FMLA eligibility requirement.

The employer must provide up to 80 hours (10 business days) of emergency paid sick leave for full-time workers (pro-rated for part-time employees or employees with varying work schedules), subject to the following limitations.

For the following situations, the employee must be paid at their regular rate of pay, with a daily limit of $511, and an aggregate limit (total amount paid) of $5,110:

- The employee is subject to a federal, state, or local quarantine or isolation order due to COVID-19;

- The employee has been advised by a health care provider to self-quarantine due to COVID-19 concerns; or

- The employee has COVID-19 symptoms and is seeking a medical diagnosis.

For the following situations, the employee must be paid 2/3 of their regular rate of pay, with a daily limit of $200 and an aggregate limit of $2,000:

- The employee is caring for an individual who is subject to or has been advised to quarantine or self-isolate;

- The employee is caring for a son or daughter under the age of 18 whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 precautions; or

- The employee is experiencing substantially similar conditions as specified by the Secretary of Health and Human Services, in consultation with the Secretaries for Labor and Treasury.

The federal government will be providing a model notice which employers will be required to post at their workplace, informing employees of their right to emergency paid sick leave. Additional guidance will be provided by the Department of Labor detailing how the emergency paid sick leave will be calculated.

It should be noted that eligible employees can use the emergency paid sick leave before using the new public health emergency paid family and medical leave time discussed below.

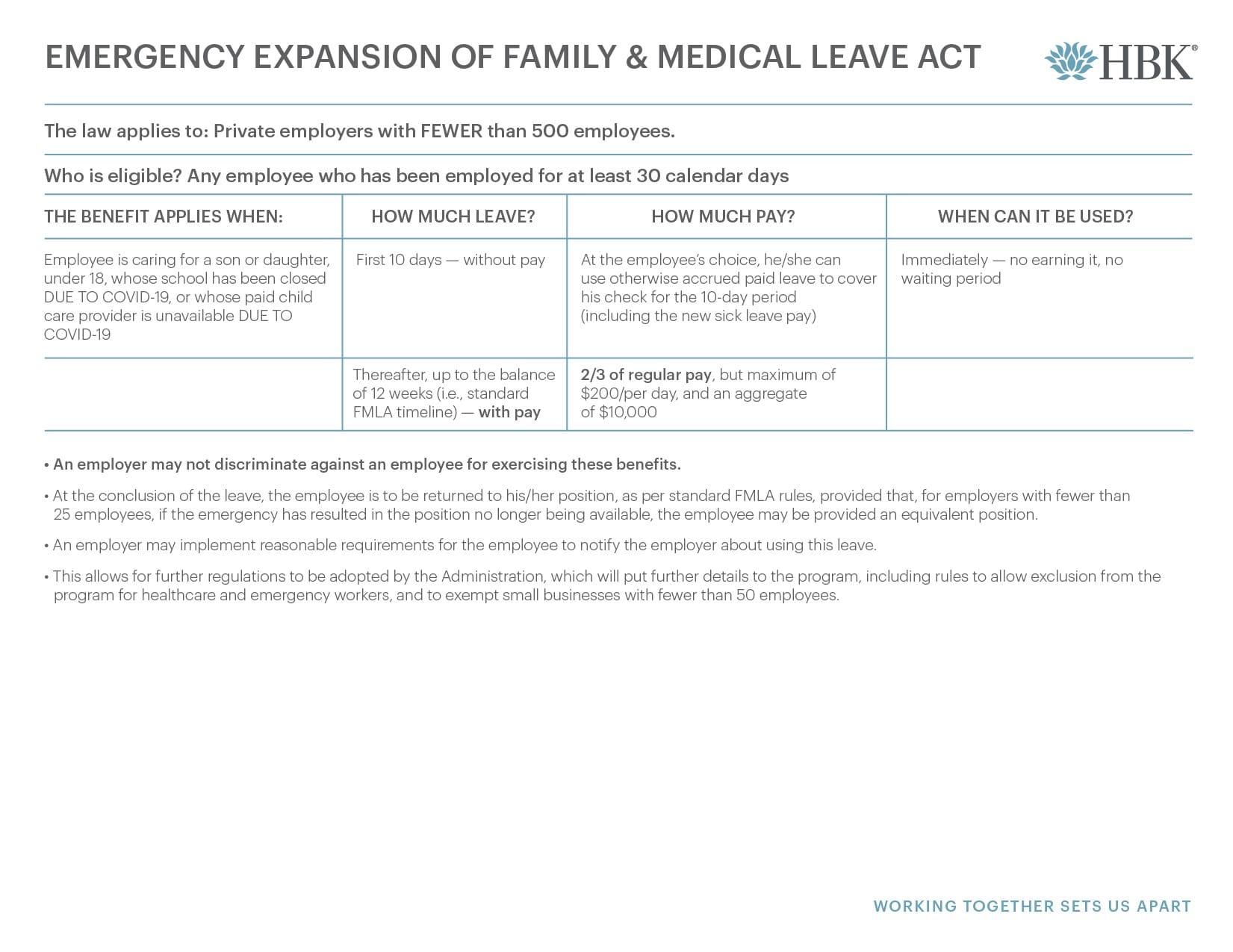

Emergency Family and Medical Leave Expansion Act – Amendment to FMLA

The Bill amends the FMLA to allow employees who have been employed for at least 30 days by employers with fewer than 500 employees with the right to take up to 12 weeks of job-protected leave, through December 31, 2020, if the employee is unable to work due to having to care for a son or daughter under age 18 if the child’s school or place of child care has been closed due to the COVID-19 public health emergency. Employers have the ability to elect to exclude health care workers and first responders from taking the public health emergency FMLA.

The first 10 days of the public health emergency leave may be unpaid, though employees may choose to use accrued paid leave. An employer cannot require employees to use this accrued paid leave time before using the public health emergency 12 weeks of leave time. After this 10 day period, employers are required to pay employees 2/3 of their regular rate of pay, capped at $200 per day ($10,000 in the aggregate per employee). Adjustments may be made for employees with varying schedules.

During this 12 week leave time, the covered employers are required to hold an employee’s job open. An exception to this general rule applies for employers with fewer than 25 employees, if the employee’s position no longer exists due to economic conditions or other changes in the employer’s operations that are caused by the COVID-19 crisis, so long as the employer makes reasonable efforts to restore the employee’s job. If those reasonable efforts fail, the employer must agree to reinstate the employee if an equivalent position becomes available within one year.

Payroll Tax Credits

The Bill creates a refundable tax credit against the employer’s portion of Social Security or Railroad Retirement Tax Act (RRTA) tax for amounts paid under the these amendments and additions to the FMLA. The credit is equal to 100% of the compensation paid to employees under these provisions in each calendar quarter, subject to the following:

- Credit cap of $511 of eligible wages per employee per day for emergency paid sick leave that is paid to employees who need time off for a quarantine or isolation order by federal, state, or local governments or by a health care provider, or if the employee has symptoms and is awaiting diagnosis of COVID-19.

- Credit cap of $200 of eligible wages per employee per day for emergency paid sick leave that is paid to employees who need time off to care for a son or daughter under the age of 18 whose school or place of care is closed.

- The credit for emergency paid sick leave wages is only available for a maximum of 10 days per employee for the duration of the program.

- Credit cap of $200 of eligible wages per employee per day for the expanded emergency family and medical leave, with an overall cap of $10,000 for all calendar quarters.

The payroll tax credit is increased by amounts paid or incurred by the employer in order to maintain a group health plan, to the extent that the amounts paid are excluded from the employee’s gross income under the internal revenue code, and are properly allocable to the respective emergency paid sick leave time, or expanded FMLA wages required to be paid under the Bill. Regulations will provide additional guidance on how this allocation may be made, though the Bill indicates that a pro rata allocation among covered employees and periods of coverage would be treated as properly made.

In addition, the payroll tax credit is increased by the amount of the employer’s liability for Medicare tax on wages that are required to be paid under the Bill.

In order to avoid a double benefit, any amount received as a credit will not be deductible. In addition, to the extent a credit in connection with the wages is allowed under another provision (e.g. the credit for paid family and medical leave under IRC § 45S), the new payroll tax credit will not be available.

Payroll Tax Exemption

Wages that are paid in connection with the above provisions will not be considered wages for the purposes of calculating the employer’s portion of the Social Security or RRTA tax. They are still considered wages for other taxes, including the employee’s portion of Social Security, RRTA, and Medicare taxes.