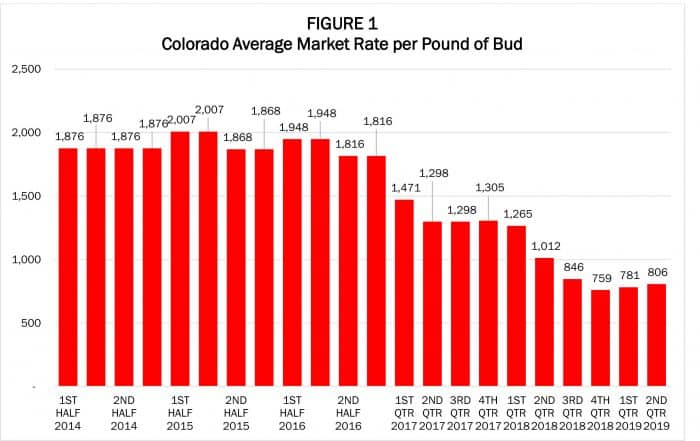

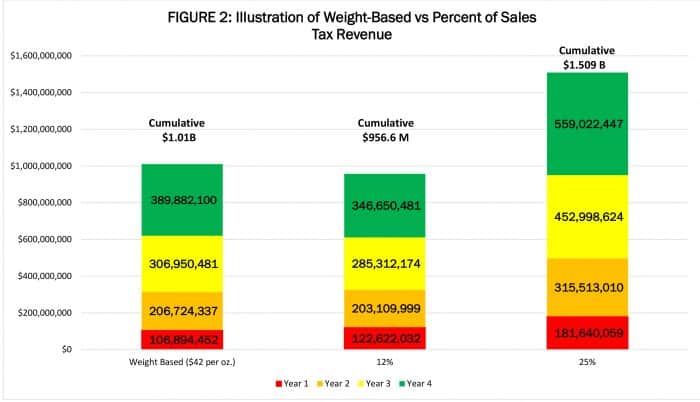

Weight-based taxes are more complicated in that it requires determining the amount of the tax and when the tax is assessed. For example, a weight-based tax could be assessed at the cultivator, processing or retail level. At the retail level, taxes would need to be set at different rates for different types of products: flower, concentrates, edibles. When taxing edibles, how would the non-cannabis ingredients be accounted for? When taxing tinctures, would the potency and quantity be considered? There are significantly more factors to consider when ‘weighing’ the options of a weight-based tax. History indicates that prices tend to be higher immediately following legalization; lower tax rates can encourage the legal purchase of cannabis. When prices decline, tax rates could be increased, keeping out-of-pocket costs to consumers the same or almost the same. If taxes are too high, whether weight-based or assessed as a percent of sales, many customers will continue to purchase through the black market. States must also consider that when the United States de-schedules or legalizes marijuana, it is highly likely a federal excise tax will be placed on sales of the product. This will replace the burden of Internal Revenue Code Section 280E currently burdening business taxpayers. What is the effect in dollars of taxing based on a percent of sales versus weight? To illustrate, we analyzed Colorado’s reported sales and the wholesale weight of flowers/buds sold from January 1, 2014, to December 31, 2018. As Colorado has not yet reported weight data for 2018 yet, we used the 2017 monthly data adjusted for the year-over-year sales increase. These computations are for illustrative purposes only and are subject to the following assumptions:

- includes only the weight of sales of flowers/buds;

- assumes no markup no profit made by the cultivator, distributor, or retailer; and

- ignores local taxes.

Based on this analysis, total sales tax collected for the five years was $52.8 million greater using a weight-based tax structure of $42 per ounce compared to the 12% percent of sales tax. Obviously, the 25% tax rate would generate more revenue – but it would likely be a less effective means of eliminating the black market. Examples of Sales Tax on Marijuana

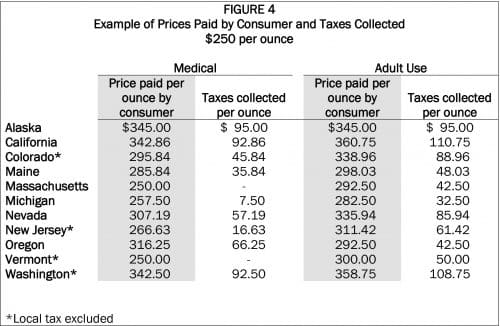

As FIGURE 3 shows, the process of taxing marijuana can range from simple to complex and the amounts of tax collected can vary significantly. Nine states (and Washington DC) do not impose their general sales tax on medical marijuana while four states (Alaska, Delaware, Minnesota, and New Hampshire) do not levy sales taxes. FIGURE 4 illustrates a sample transaction ($250 per ounce based on no markup of product and all taxes being passed through to the consumer) in both medical and adult use markets and the different amounts that would be charged to the ultimate consumer and the taxes collected. On the medical side, the purchase of an ounce of marijuana results in a purchase price ranging from $250 to $342.50, depending on the state. For adult use, the price paid would range from $282.50 to $360.75.

Under the weight-based tax structure ($42 per oz), the consumer’s cost for medical marijuana would be $266.63 (the fourth lowest, with two states levying no taxes). For adult use, the $42 per ounce tax would result in being at the halfway point compared to other states. It is very important to realize that the price will not be the same in all states and that this example is presented for comparison purposes only. Sources: Colorado Marijuana Enforcement Division’s Market Size and State Demand for Marijuana in 2017 – Market Update (Aug. 2018) https://www.colorado.gov/pacific/sites/default/files/MED%20Demand%20and%20Market%20%20Study%20%20082018.pdf Colorado Marijuana Enforcement Division: 2016 Annual Report https://www.colorado.gov/pacific/sites/default/files/2016%20MED%20Annual%20Report_Final.pdf Colorado Marijuana Enforcement Division’s Market Demand and Size Study, July 2014 https://www.colorado.gov/pacific/sites/default/files/Market%20Size%20and%20Demand%20Study%2C%20July%209%2C%202014%5B1%5D_3.pdf https://www.colorado.gov/pacific/revenue/colorado-marijuana-tax-data https://www.colorado.gov/pacific/revenue/colorado-marijuana-sales-reports https://www.colorado.gov/Tax/marijuana-taxes-file Economic Impact of Tourism in New Jersey, 2017 – January 2018) https://www.visitnj.org/sites/default/files/2017-nj-economic-impact.pdf

Speak to one of our professionals about your organizational needs

"*" indicates required fields